Ethereum Price Prediction: Technical Breakout and Institutional Momentum Signal Path to $6,000

#ETH

- Technical Breakout Potential: ETH trading above its 20-day moving average with positive MACD momentum suggests continued upward movement toward resistance at $4,910

- Institutional Accumulation: Major players including SharpLink Gaming and BlackRock's ETF are accumulating substantial ETH positions, creating significant buying pressure and long-term support

- Price Target Convergence: Multiple analysts project targets reaching $6,000 with some long-term predictions as high as $20,000, indicating strong bullish sentiment among market professionals

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

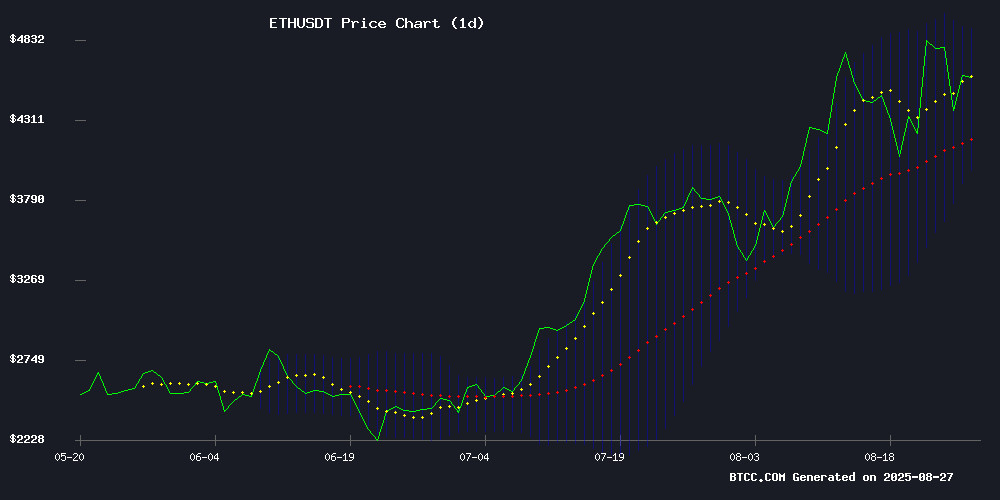

ETH is currently trading at $4,616.24, positioned above its 20-day moving average of $4,444.93, indicating underlying strength. The MACD histogram shows positive momentum at 141.59, though both MACD lines remain in negative territory. Price action NEAR the upper Bollinger Band at $4,910.09 suggests potential resistance, while the middle band at $4,444.93 provides support. According to BTCC financial analyst Emma, 'The technical setup favors continued upward movement, with a break above $4,910 potentially triggering further gains toward $5,200.'

Institutional Accumulation Drives Bullish Ethereum Sentiment

Recent institutional activity signals strong confidence in Ethereum's prospects. SharpLink Gaming's expansion to 797,704 ETH holdings alongside a $1.5 billion buyback plan, combined with BlackRock's ethereum ETF seeing $314 million in inflows, creates substantial buying pressure. Analyst predictions of $6,000 targets and even $20,000 long-term projections reflect growing optimism. BTCC financial analyst Emma notes, 'The convergence of institutional accumulation and positive technical indicators creates a compelling bullish case for ETH, though traders should monitor for potential volatility around key resistance levels.'

Factors Influencing ETH's Price

Ethereum Price Rally: Analyst Predicts $6,000 Target Amid Institutional Accumulation

Ethereum's price trajectory is drawing bullish attention as analyst Merlijn Trader projects a $6,000 target using the Wyckoff Model, a century-old market framework. The model's accumulation phase completion—marked by a 'Spring' pattern breakout—suggests parabolic upside potential. ETH traded at $4,519.58 at press time, with critical support at $4,700 needed to sustain momentum toward $5,000.

Institutional demand intensifies as BlackRock acquired 65,901 ETH ($315.6 million) in a single day, while BitMine Immersion solidified its position as the largest Ethereum treasury holder with 1.7 million ETH. Market liquidity swells alongside speculation: Binance recorded record leverage ratios and $1.65 billion in stablecoin inflows, signaling heightened trader conviction.

SharpLink Gaming Expands Ethereum Holdings to 797,704 ETH Amid $1.5B Buyback Plan

SharpLink Gaming has aggressively expanded its Ethereum treasury, adding 56,533 ETH last week at an average price of $4,462 per token. The $252 million purchase brings total holdings to 797,704 ETH worth $3.7 billion, funded partially through a $360.9 million equity raise.

The company retains $200 million in dry powder for additional acquisitions while earning 1,799 ETH in staking rewards since June. A newly approved $1.5 billion stock buyback program creates dual catalysts - supporting the share price while maintaining crypto accumulation strategy.

Despite Monday's 6.8% dip to $0.96, SBET shares have rallied 150% YTD. Analysts project potential upside to $40 if Ethereum reaches $6,000-$7,000, betting on the gaming firm's unconventional transformation into a crypto-heavy balance sheet play.

BlackRock's Ethereum ETF Sees $314M Inflows as Institutional Confidence Rebounds

BlackRock's Ethereum ETF (ETHA) recorded a $314 million inflow on August 25, marking a sharp reversal from earlier outflows. The fund absorbed 67,899 ETH as institutional traders returned, with total Ethereum ETF volumes exceeding $2.4 billion.

Tom Lee of Fundstrat suggests Ethereum may be approaching a price floor, signaling potential stabilization. This follows a turbulent period where ETH products bled $924 million between August 15-20, including a single-day $429 million withdrawal.

The recovery highlights shifting sentiment among sophisticated investors. While Fidelity and Grayscale's ETH products faced similar outflows earlier, BlackRock's rebound suggests renewed appetite for crypto exposure through regulated vehicles.

SharpLink Expands Ethereum Holdings with $3.7B Purchase

SharpLink has bolstered its Ethereum reserves with a $3.7 billion acquisition, purchasing 56,533 ETH at an average price of $4,462 per token. The firm's total holdings now stand at 797,704 ETH, solidifying its position as a major institutional holder.

With $200 million in cash earmarked for additional purchases, SharpLink's aggressive accumulation strategy underscores its conviction in Ethereum's long-term viability. The move reflects growing institutional confidence in ETH's role as a cornerstone of decentralized finance and Web3 infrastructure.

Ethereum Faces Uncertainty Amid Rally as Traders Eye High-Return Altcoins

Ethereum's recent surge past $4,000 has reignited bullish sentiment, yet skepticism lingers about its ability to sustain momentum. The second-largest cryptocurrency briefly dipped today after a two-week rally, fueling debates about whether it will retest $5,000 or fall below key support levels before year-end.

Market participants are increasingly diversifying into emerging tokens like RTX, the native asset of Remittix, which show potential for outsized returns during this cycle. This shift reflects broader appetite for altcoins as Ethereum's dominance wavers.

Ethereum's Onchain Data Signals Potential Rally to $20k as Analysts Bullish

Ethereum's market trajectory suggests a significant upward movement, with onchain metrics indicating the cryptocurrency remains undervalued despite its recent 240% surge. The long-term holder net unrealized profit/loss indicator has entered the 'belief-denial' zone, a historical precursor to major price rallies.

Analysts point to technical targets between $7,000 and $12,130, with some projections reaching as high as $20,000 for this cycle. The current market value to realized value ratio of 2.08 supports the argument that ETH has room for growth before hitting extreme profit levels.

Glassnode data reveals investor profitability mirrors previous bull market cycles, yet the market hasn't reached the euphoric stage typical of cycle peaks. 'For the transition from belief to euphoria to occur, ETH price needs to climb further,' noted analyst Gert van Lagen.

Ethereum Price Ready for Q4 Crypto Rally After 83% Q3 Gains

Ethereum enters September with bullish momentum after an 83% surge in Q3—its strongest performance since launch. The token briefly hit a record $4,946 before stabilizing near $4,550, supported by $23 billion in U.S. ETF inflows. Analysts cite historical patterns where robust Q3 gains precede parabolic Q4 rallies, as seen in 2017 and 2021.

Technical indicators point to critical support at $4,350, with Standard Chartered revising its year-end target to $7,500. On-chain upgrades like Pectra’s rollup cost reductions and Layer-2 TVL exceeding $44 billion further bolster fundamentals. Despite September’s volatility risks, Tom Lee’s call for an imminent ETH bottom adds fuel to the optimism.

Ethereum Price Prediction September 2025 – Can ETH Break $5,000?

Ethereum is poised for a historic rally, with Q3 gains already surging 77% and a recent all-time high near $4,946. Institutional inflows have reached $11 billion this year, while U.S.-listed Ethereum ETFs now hold over $23 billion—a clear signal of growing mainstream adoption.

Staking activity further tightens supply, with 29% of ETH's total circulation locked up for rewards. Historical patterns suggest Q3 outperformance often precedes explosive Q4 rallies, as seen in 2017, 2020, and 2021 when follow-through gains exceeded 100%.

Ethereum Whales Accumulate During Flash Crash as Tom Lee Predicts Bottom

Ethereum plunged 7% to $4,313 during Tuesday's market-wide crypto selloff before rebounding above $4,430. Fundstrat's Tom Lee accurately called the bottom, predicting ETH would stabilize within hours and target $5,100-$5,450.

BitMine capitalized on the dip, acquiring 4,871 ETH worth $21.3 million. The institutional holder now controls 1.72 million ETH ($7.5 billion), commanding 40% of corporate Ethereum treasuries.

Technical analysis suggests September 2025 price targets between $4,767 and $5,817. The flash crash represented an 11% retracement from ETH's recent 2025 highs above $4,950 on Coinbase.

Is ETH a good investment?

Based on current technical indicators and market developments, ETH presents a compelling investment opportunity for risk-tolerant investors. The cryptocurrency trades above its key 20-day moving average with positive MACD momentum, while institutional accumulation from major players like SharpLink Gaming and BlackRock's ETF inflows provide fundamental support.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $4,616.24 | Above 20-day MA support |

| 20-day MA | $4,444.93 | Bullish positioning |

| MACD Histogram | +141.59 | Positive momentum |

| Upper Bollinger | $4,910.09 | Near-term resistance |

| Institutional Inflows | $314M+ | Strong fundamental support |

While short-term volatility may occur around the $4,910 resistance level, the combination of technical strength and institutional adoption suggests potential for movement toward the $6,000 analyst targets. Investors should consider dollar-cost averaging and maintain appropriate position sizing given cryptocurrency's inherent volatility.